Types of employers

Government departments (statistics, central banks, competition, finance, etc), policy-oriented institutes/centers of universities and liberal arts colleges, research departments of commercial banks and other private firms, economic consulting firms, non-profit organizations, think tanks etc.

Some examples of employers

HKMA, HK Competition Commission, Compass Lexecon, Charles River Associates, HSBC, Microsoft Research, Amazon, Federal Reserve Banks, Brookings Institution, HKIAPS, etc.

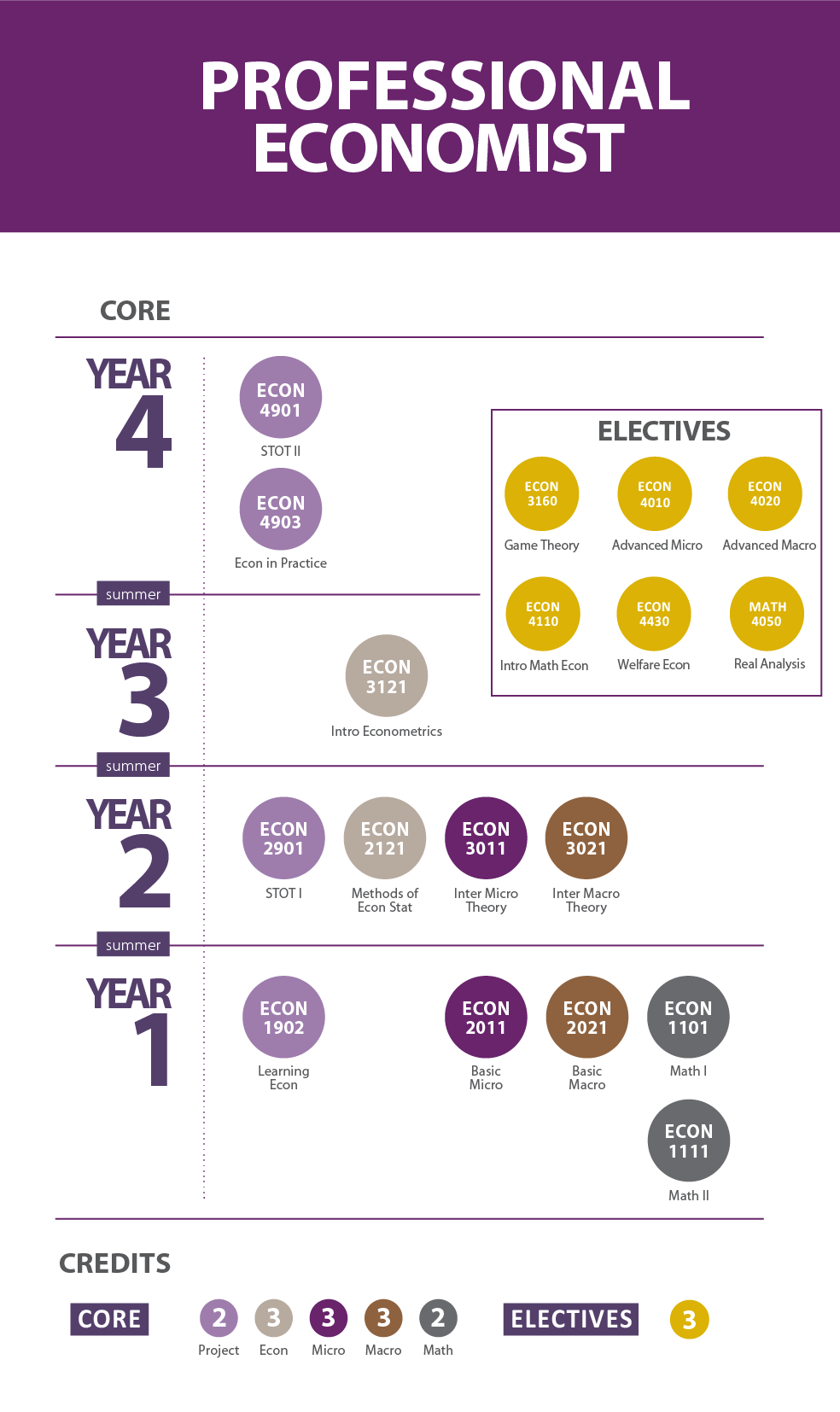

Relevant courses

Find more info for non-economics requirements: https://www.cuhk.edu.hk/334/english/curriculum-structure/index.html

Study path

The study path leads to attaining a solid MPhil/MSc degree from a decent school. Some institutions, particularly the top economic consulting firms, would require a decent PhD degree. The main duties require you to make use of your knowledge of economics and its applications to various areas.

Undergraduates interested in being a professional economist should plan ahead carefully. Coursework is not enough. Again, strong recommendation letters from your professors are crucial. To get them, they have to know you and your work. This requires extensive RA experience. You are strongly encouraged to attend as many seminars and conferences as possible from CUHK Economics. Do try to hunt down professional economists outside of the department. CUHK Economics occasionally invites non-academic professional economists for talks and other events. Try to get to know them and their professions in these events.

Do also consider ECON 2901, 4901 and 4910/4920 as the opportunities for you to dive deeper into a subject area. For example, if you are fond of antitrust, why not develop all your term papers on a particular area of antitrust (e.g., mergers)? Your second year statistics and the third year econometrics are also opportunities for you to apply statistical tools to merger analyses. Doing so, in a matter of 2 or 3 years, you should have a reasonable grasp of the landmark merger cases, as well as having the economic tools needed to address some of them quantitatively. They would be immensely useful for you to convince your professors that they should write you very strong recommendation letters. Ultimately, when you walk into an interview room of say, HK Competition Commission, you are confident that you know the inside-out of what mergers are all about.